What is an EZ Lease?

It’s like a traditional lease — ONLY BETTER!

The EZ Lease is a multi year lease-to-own financing option. The EZ Lease will allow you to reduce the amount of your payments during the first year of your lease. You also get to choose how long you would like to finance - 2, 3, 4 or 5 years. At the end of your lease you will fully own the equipment. Reducing the monthly payments for the first year often reduces the level of stress, allowing you to focus on growing your business when it matters most!

Here are THREE Examples of a 12 month Reduced Payment Lease,

aka: The EZ Lease!

EPSON SureColor® F2270 = $16,495

Payments as low as = $290.00/month for the first 12 months*

(This example is for the Epson F2270 printer only. Printer only price includes basic ink and supplies and does not include any other machines or additional accessories.)

EZ-JET PRO 17 DTF Printer System = $19,995

Payments as low as = $350.00/month for the first 12 months*

(This example is for the EZ-JET PRO 17 DTF printer system which includes the Printer, the Powder / Shaker / Heater unit. It also includes basic ink and supplies. It does not include the floor stand, any other machines or additional accessories.)

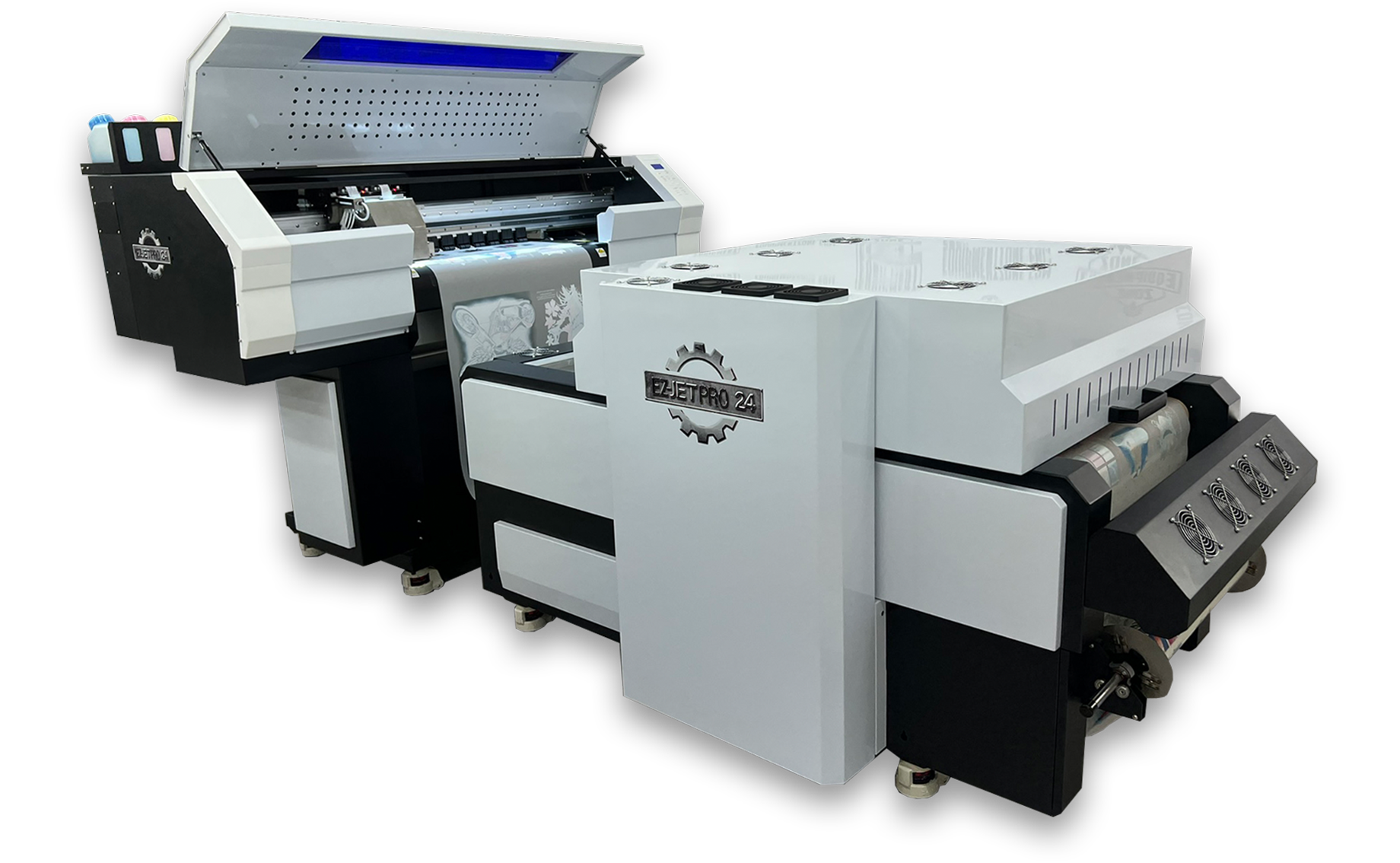

EZ-JET PRO 24 DTF Printer System = $23,995

Payments as low as = $420.00/month for the first 12 months*

(This example is for the EZ-JET PRO 24 DTF printer system which includes the Printer, the Powder / Shaker / Heater unit. It also includes basic ink and supplies. It does not include any other machines or additional accessories.)

* with approved credit